BigTime will allow you to share three different types of expenses with QuickBooks: employee expenses, vendor expenses and corporate card expenses. We cover each of these expense types in more detail in the Expenses chapter.

Here, we'll talk about how to import/export each of those types of expenses.

|

See Also |

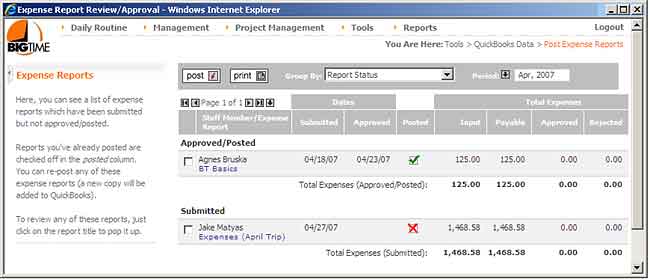

Once an employee submits an expense report, you can post it into QuickBooks as a "bill" that's payable to the employee. You'll do that from the Tools... QuickBooks Data... Post Expense Reports screen.

You can change the PERIOD that you are reviewing at the top of the form, since you'll only see one period's expense reports at a time. You can also see what expenses have been approved and which ones haven't from the columns on this page. When you're ready to post these expenses to QuickBooks, just follow these steps:

Keep in mind, each line item on your BigTime expense report will need to map to an item on your QuickBooks bill. In BigTime, we manage that link using the Expense Category listing.

Each expense category in BigTime can be linked to either a QuickBooks "item" or to a QuickBooks "expense G/L account." By setting those links in the Tools... System Settings... Expense Categories list, you can make sure each line item in an employee's expense report is logged properly when BigTime creates a bill in QuickBooks.