If you have contractors or vendors tracking their time and expenses in BigTime, then you can use that information to generate a bill that posts directly into QuickBooks. That eliminates the need to post time entry data into QuickBooks, and it gives you an arms-length invoice document that the vendor can use to submit an offical request for payment.

The Vendor Bill feature in Bigtime isn't the only way to convert a contractor's timesheet into a bill. Keep in mind that you can post timesheet and expense details to QuickBooks instead (QuickBooks has a facility for converting time entry data into a "bill" for a vendor as well). Finally, many firms prefer to have their vendors send bills that they generate themselves (so that they can cross-check those bills against the data in BigTime).

This section of the manual will walk you through the process of creating vendor bills in BigTime. Then, we'll walk through some of the optional settings and reports you can use to make custom-fit that process to your firm's specific requirements.

|

See Also |

To turn on this feature, just browse to your QuickBooks Data...Settings page. There's a check box to turn on vendor bill creation. Just check it off and click the save button.

When you do, you'll see a new Vendor Bills menu within the QuickBooks data menu. You'll use the items on that menu to create and post vendor bills.

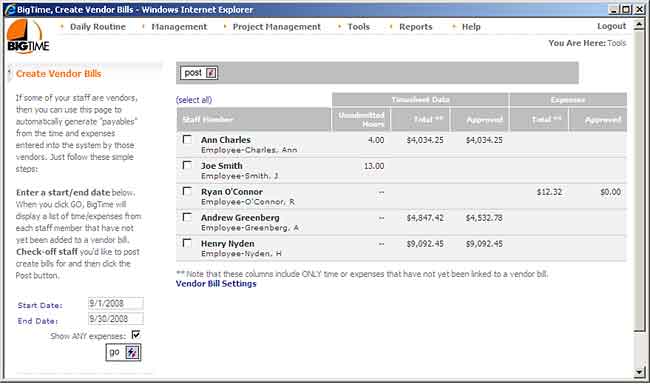

To create a set of bills based on a contractor's time and expense data, just browse to the Tools...QuickBooks Data...Vendor Bills menu and choose the Create Vendor Bills option. When you do, you'll see a screen similar to the one shown here.

When you're ready to create one or more vendor bills, just check off the contractors for whom bills should be created in the list on this page. Then, click the POST button at the top of the page.

BigTime will queue up those bills and it will let you know when they've been completed.

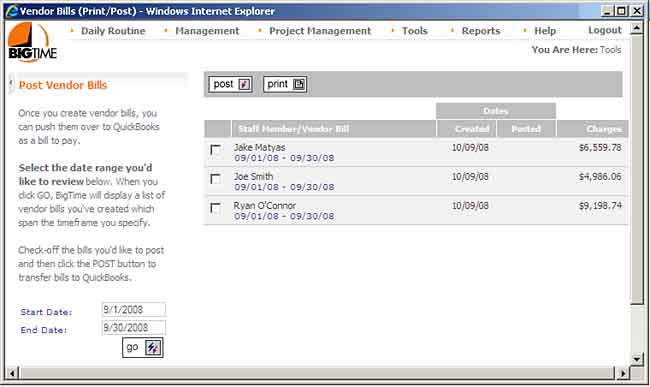

Once you have created one or more vendor bills, you can review and post them from the Tools..QuickBooks Data...Vendor Bills menu. Just click the Post Bills to QuickBooks selection, and you'll see a screen similiar to the one shown here.

Posted vendor bills appear in QuickBooks as a bill, payable to the staff member's vendor record.

You can adjust the level of detail that appears in your vendor bills by tweaking your vendor bill settings. There's a link to this page on the Create Vendor Bills page (under Tools...QuickBooks Data...Vendor Bills), and you can also link to it from the QuickBooks Data...General Settings page.

The system will post a summary of time entry data (eg - hours and rate) based on the items you select on this page. You can summarize data by project, class, service item (e.g. - labor code or budget item) or billable status. You can also combine those fields in any combination.

If you elect to push the date or time entry note information into your vendor bill, then one line item will be create for every time entry attached to the vendor bill. You should also note that both the date and the notes are placed in the description column of your vendor bill.

While most firms will post expense reports for their contractors using the same workflow they have setup for their employees, some firms prefer to post time and expense report data onto the same vendor bill. You can include expenses on your vendor bills by turning on one of the expense posting options.

If you don't include expense data on your vendor bills, then BigTime will ignore expense data when it creates new vendor bills.

Note that you should post EITHER expense reports OR vendor bills that include expense data, but you shouldn't post both (otherwise, you'll create duplicate payables for the same expense in QuickBooks).