BigTime can be used to enter corporate card expenses (e.g. - items that are purchased by your staff using a corporate card). If your firm would like to track corporate card expenses, you'll need to configure the system properly.

Assuming the system has been setup to allow corporate card expense entry, then users simply enter them just like any other expense, but they are flagged as "corporate card" expenses (so you won't include them on your employee bills when those expense reports are posted into QuickBooks).

|

See Also |

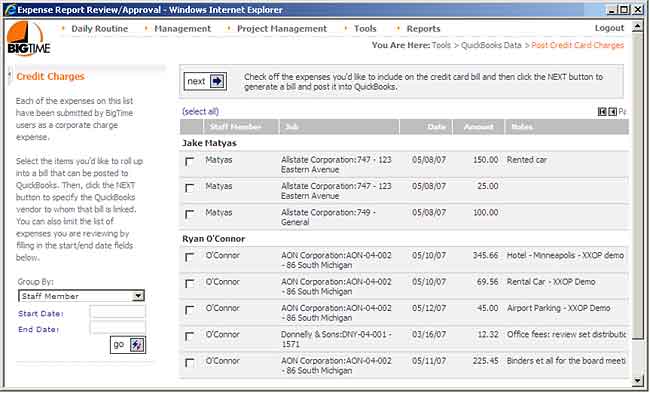

When a user submits an expense report with corporate card charges on it, those corporate charge expenses fall into an "un-posted pool" of corporate charges. You can grab all of those charges (or just a sub-set of them), and post them to QuickBooks.

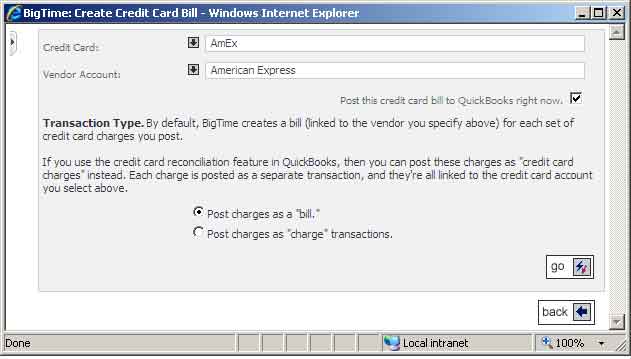

Once you've selected the items you'd like to generate a report from, you'll see a page similar to the one shown here. You can decide which credit card account/vendor you'd like to link these expenses to, and then click the GO button to create a new expense report.

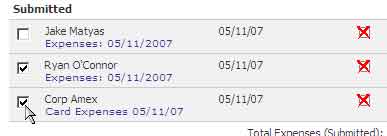

Once the credit card expense report has been created, you can post it to QuickBooks as a bill, just like any other expense report. Note that these "credit card" reports are linked to a specific credit card vendor account (not to an employee in BigTime).

Even though these expenses are posted as a separate "bill" to QuickBooks, you'll still be able to see the expenses associated with that credit card bill on the employee's expense report detail page(s).

If you'd rather take advantage of the QuickBooks credit card reconciliation screens, then you can post your credit card charges as "charges" in QuickBooks (instead of as a bill payable to the credit card vendor).

To accomplish that, you'll follow the same steps you did when creating a vendor bill for credit card charges (above).

Now, when you post the credit card bill you create, it will create a series of credit card charge items (instead of a vendor bill). Note that each charge is a separate "transaction" in QuickBooks (there is no way to list all of the charges on a single credit card "charge" item and still allow you to reconcile each one separately).

Whether you intend to post these credit card charges as a "bill" (payable to the credit card company) or as separate "credit card charge" documents, BigTime pulls all of the charges you've selected onto a virtual expense report that can be posted to QuickBooks collectively.

If that virtual expense report is ever deleted, the credit card charges that are attached to it will simply drop right back into the "un-collected" pool of charges.

If you make a mistake and want to re-select the items on your virtual expense report, just delete it and re-create it.