BigTime can be used to enter two types of expenses: regular employee reimbursable expenses (e.g. - things your staff purchases for which they need to be reimbursed) and corporate card expenses (e.g. - items that are purchased by your staff using a corporate card that you pay directly). If your firm would like to track corporate card expenses, you'll need to configure the system so that users are allowed to enter them.

NOTE that BigTime also tracks vendor expenses and service fees. Take a look at the Expenses chapter for more information on these additional expense types.

|

See Also |

From the Tools...System Settings...General Settings page, check off the "Allow users to enter corporate card charges" check box (in the Expense Settings area at the bottom of this page) and click the SAVE button.

This will turn the "non-reimbursable" flag in your expense entry screen(s) into a "corporate charge" flag. While that designation won't make much difference in how you bill/track that expense, it will make a difference when it's time to post that expense to QuickBooks. Instead of posting as a payable to your employee, it will be posted as a payable to the corporate credit card.

When a user enters an expense in the system, they can flag that expense as "non-reimbursable" (e.g. - a customer expense that the employee didn't purchase). We use that flag field to record corporate card charges when credit card expense entry is activated. So, if you activate corporate charge tracking, you should change the label for that field in your system's vocabulary.

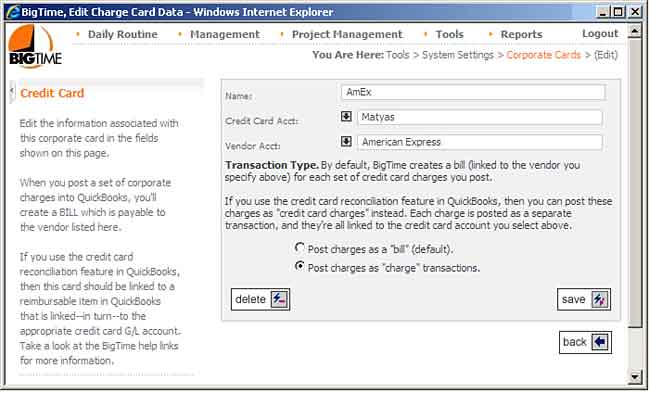

Once you've activated the corporate card tracking facility, you'll see a new menu item in the Tools...System Settings menu called Corporate Cards. You can use that screen to create and manage one or more credit card accounts in BigTime. Each account will be linked to a specific credit card account in QuickBooks as well as a vendor account.