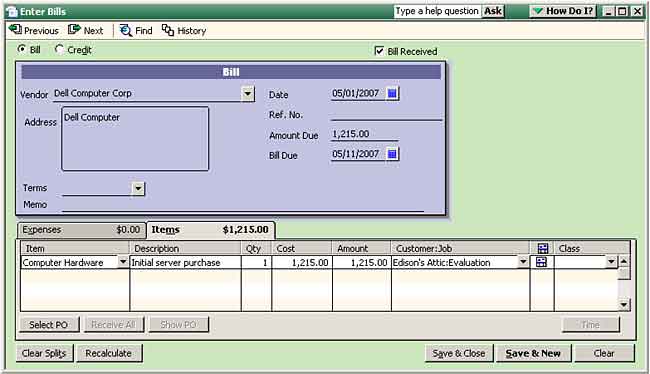

BigTime can read and/or import any vendor expenses you enter into QuickBooks (e.g. - bills, checks, PO receipts or credit card charges) as long as those expenses are recorded against a valid BigTime project. Below is a screen shot from a QuickBooks bill that has been recorded against a sample BigTime project.

The bill is fairly simple: a computer purchase for a customer. Take a look at the line item for the bill.

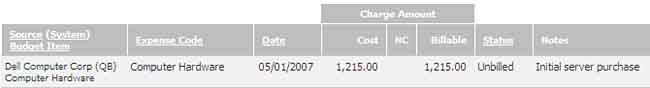

BigTime will spot that expense entry when it does the nightly sync, and it will pull that vendor expense into our list of expenses on the project. When we take a look at the expense "detail" for this project, BigTime will show us that there are $1,215.00 in "unbilled expenses" for this project, and it will show us the detail that it pulled from QuickBooks.

|

See Also |

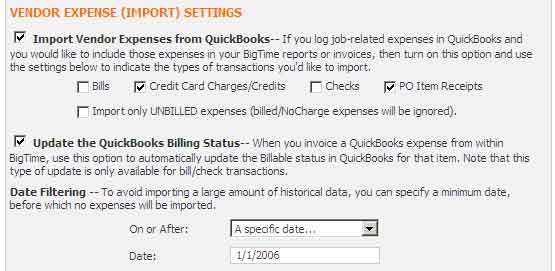

How did BigTime know to pull that particular bill? Because we told it to. You can edit your firm's preferences when it comes to importing vendor expenses from QuickBooks. In the advanced settings for QuickBooks, you'll see that BigTime can be setup to automatically pull vendor expenses from QuickBooks according to several parameters.

Each of these options are supported by only certain versions of QuickBooks, and all of them are supported by version 2005 or higher. Take a look at the QuickBooks settings chapter to learn more about each option.

In the meantime, you may also want to keep in mind that these expenses are imported as a part of the nightly sync. If you are working with both systems and would like to import new bills/expenses right away (without waiting for the nightly sync), then you can kick off a manual import by going to the Tools... QuickBooks Data... Manual Imports screen.

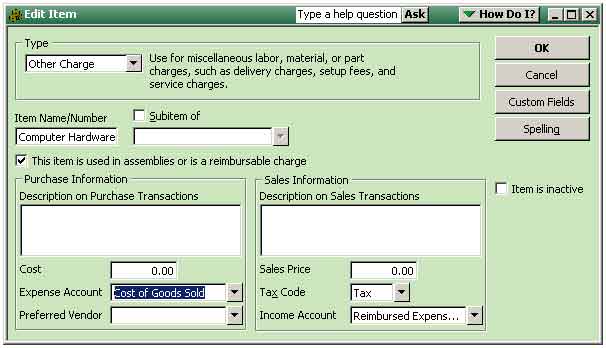

Line items linked directly to COGS accounts can't be imported from QuickBooks. That's because there is no way to mark these items as "billed" or "unbilled" (a feature that is part of the design in QuickBooks). If you'd like to pass-through COGS expenses, then link them to an "item" in QuickBooks instead.

Once you do that, your expenses will accrue against your COGS account in QuickBooks, and your bills will still support the "billable" field.

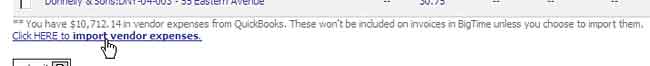

You can see what unbilled "QuickBooks" expenses exist in that system from the Tools... Invoices, Create Drafts screen. The final column on that grid shows you the unbilled QuickBooks expenses that need to be imported for every project in the system. To import expenses (for a single project or for all of the projects in the system), just follow these steps.

Once vendor expenses have been imported from QuickBooks, the "billing status" on those expenses is now controlled by BigTime. Those expenses now behave just like BigTime expenses. They can be edited, marked up, re-classified, marked as "no-charge," invoiced or deleted.

When these expenses show up on a BigTime invoice, the "staff member" name that appears next to a BigTime expense is replaced with your "vendor name" from QuickBooks.

You can edit those expenses (changing the date, the amount, the category or budget item links, etc.) in BigTime, but any edits you make will not flow back into QuickBooks. That's because QuickBooks doesn't support a "payable" vs. "billable" amount, and BigTime does. So, any edits you make to the billable amounts are stored in BigTime, but they don't change the "payable" in QuickBooks.