Most of the time, you'll use the Contract... Invoice Format page to select a specific invoice type for each project and to setup the sub-totalling options for your project's invoices. However, there are a few additional options you can edit on the Contract... Invoice Format page.

|

See Also |

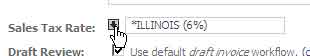

If your system is setup to calculate sales taxes on the invoices you create, then you can tell the system to use a specific "default" tax rate on each of the projects you add to the system. Note that you'll need to turn on sales tax calculations in your System Settings before you'll see the "default tax rate" selection option in the Invoice Format page.

This selection box will appear on your project's dashboard (under Contract... Invoice Format) and the list of rates is pulled from your sales tax rate list in QuickBooks.

If you are asking managers to review/approve invoices, then you can setup a default "workflow" for routing those draft invoices to the right people. For most firms, each project will use your firm's "default" draft invoice workflow.

If you'd like to setup a custom workflow for a specific project, then you can use the draft workflow settings on the dashboard's Contract... Invoice Format page to accomplish that. Just turn OFF the checkbox that says "use default workflow" and then click on the "custom workflow" link to edit the list of people to whom this particular project's invoices should be routed.

Every invoice you create in BigTime has a space for two invoice "notes." Those notes are general notes for the overall invoice (they aren't linked to any specific charge item), and they are pre-filled with whatever notes you place in the notes fields that appear on the project's Invoice Format page.

What you place in those invoice notes is up to you. Some firms put client-specific PO or reference numbers. Some people fill in data on the project's scope of work. Each field has up to 1000 characters of data, and can be left blank if you don't plan to use them.

Whatever you type into those fields, keep in mind that they are just "default" notes for new project invoices. You can still edit that note when you create a new invoice, and any edits you make on the invoices themselves aren't saved back to the dashboard.

The Contract Note is a one or two line note that appears ONLY on the Tools...Invoice, Create Drafts screen. It's an excellent spot to store contract-specific invoicing instructions that you (or your billing manager) may need as you create invoices. You can store anything you'd like in the contract notes, and they don't appear on any of BigTime's standard printed invoices (so your customers don't see them).

BigTime can be used to bill expenses as well as time. That option is enabled by default, and you can control it using the Tools... System Settings... Workflow screen.

Once that setting is turned on, then an "Expenses" line item is automatically added to all of your existing invoice formats.

Note that the expenses line item has the same options (e.g. - subtotalling) as the time-charge line item(s) we've looked at earlier in this chapter.

Also note that most of BigTime's status screens and reports distinguish between "fees" and "expenses," so you can keep track of each one separately.