If you charge sales tax on your invoices, then you'll need to activate sales taxes in BigTime. There's a pick list for the sales tax setting on the Tools... System Settings... General page, and it lets you select the type of sales tax calculation your firm uses.

|

See Also |

The tax rates listed in your system are pulled from your QuickBooks data file, so you don't need to maintain a separate "tax rate" list in BigTime and in your accounting package. We pull tax rates automatically as a part of your nightly sync, and you can pull them into the system manually (if you'd rather not wait for the nightly sync), by updating Lists/Lookups in the Tools... QuickBooks Data... Manual Imports page.

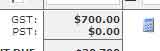

When you activate sales taxes, you'll see a separate line (or lines) in each invoice screen/report that shows sales taxes due. That line is similar to the screen shot shown below.

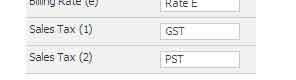

Note that this invoice is using the UK/Canadian tax format, so there are two line items in the sales tax area. The first one is labeled "GST," and the second one is labeled "PST." Those labels are pulled from your Tools... System Settings... Vocabulary area. There, you'll see a label for "Sales Tax (1)" and "Sales Tax (2)".

If I change the label for "Sales Tax (1)" from "GST" to "GST #3333333", then I can place my company's GST number right next to the GST amount on my invoice. For Canadian or UK firms, that's one (optional) way to place your registration number onto printed invoices.