The advantage of tracking trust funds as described in the previous section is the ease with which account reconciliations and registers can be printed.

You can reconcile each of your physical bank accounts by selecting the master/sub account to which the physical account corresponds. Each month, you can print out bank reconciliations as required by your state. For pooled accounts, QuickBooks allows you to reconcile at the pooled account level and then report (or print reconciliations) at the sub-account level.

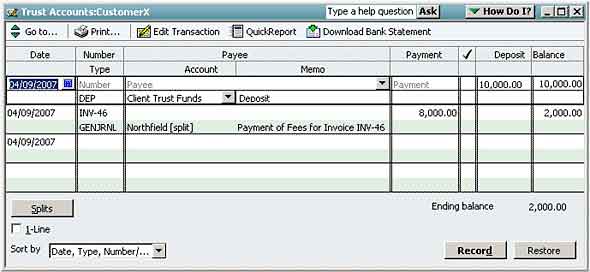

Each of your bank accounts has a register with the details of each transaction posted to the account. Below is a screen shot of the register for CustomerX (per our example in the previous section).

Each customer account has a record of invoices/payments as well, and you can produce a "trial balance" by simply running a quick-report on any of the bank accounts in the system. Each state's reporting requirements are different, but most of your reporting needs should be met via those three simple reports in QuickBooks.

|

See Also Setting up QuickBooks for Trust Invoicing Setting up a Master Trust Bank Account |